The UAE continues to position itself as one of the most dynamic real estate and investment destinations in the world. With Dubai and Abu Dhabi leading the way, the market has shown resilience and adaptability in the face of global economic challenges. As we approach the end of the year, investors are carefully analysing trends that will shape opportunities across the sector. Understanding these movements is essential for making strategic decisions that maximise both short-term gains and long-term growth.

Sustained Demand for Prime Residential Properties

Residential real estate has been one of the strongest drivers of the UAE property market this year. High-net-worth individuals and international buyers are fuelling demand for luxury homes, waterfront residences, and branded developments. Projects in areas such as Palm Jumeirah, Dubai Hills Estate, and Saadiyat Island continue to see strong absorption rates. This trend highlights the UAE’s status as a safe haven for wealth, where investors seek both lifestyle benefits and capital appreciation.

At the same time, mid-market housing remains critical for sustained growth. Rising demand from young professionals, families, and regional expatriates ensures that developments catering to affordability and community living remain attractive investment opportunities.

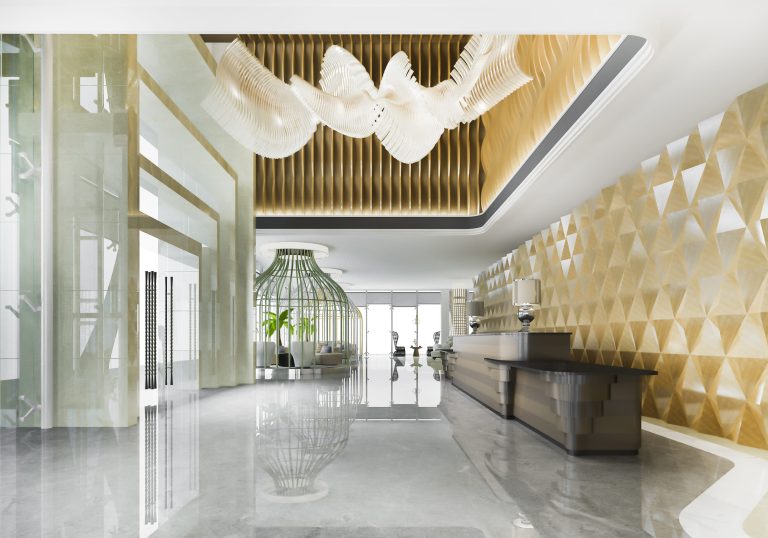

Hospitality and Tourism as Growth Engines

The UAE’s hospitality sector is experiencing renewed momentum, driven by record-breaking visitor numbers. Dubai’s continued success as a global tourism hub, along with Abu Dhabi’s cultural and leisure projects, are creating opportunities for investors in hotels, serviced apartments, and mixed-use developments. With upcoming global events, the demand for high-quality hospitality assets is expected to remain strong, offering investors consistent rental yields and long-term appreciation.

Commercial and Office Spaces Evolving

The commercial real estate segment is undergoing transformation as companies rethink their workplace strategies. Flexible office spaces and mixed-use developments are gaining traction, particularly in Dubai’s business districts. Demand is shifting towards sustainable, technologically advanced buildings that can support hybrid working models. Investors looking at commercial assets should focus on projects that prioritise efficiency, design innovation, and environmental standards.

Regulatory Environment and Investor Confidence

The UAE government continues to strengthen the regulatory framework to enhance investor confidence. Reforms in property ownership laws, residency schemes, and business regulations are opening doors to wider participation from international investors. For instance, long-term visas linked to property investments have made the UAE even more appealing for those seeking security and stability. Staying informed about these regulations is vital, as they directly impact the feasibility and structure of investment strategies.

The Role of Sustainability in Investment Decisions

Sustainability is no longer optional in real estate and development. Green buildings, energy-efficient designs, and smart infrastructure are becoming central to new projects across the UAE. Investors are increasingly looking at sustainability not only as a compliance factor but also as a driver of long-term value. Developments that integrate urban planning with community well-being and environmental responsibility are likely to outperform in the years ahead.

Capitalising on Infrastructure and Mega Projects

The UAE is known for its ambitious infrastructure projects, and the pipeline remains strong. From new transport networks to landmark cultural and leisure destinations, these initiatives continue to boost surrounding real estate markets. Investors who identify land or projects near these developments can benefit from long-term capital growth. The government’s Vision 2030 initiatives in both Dubai and Abu Dhabi are key drivers of urban expansion and sustainable development.

Mitigating Risks Through Feasibility and Advisory

Despite the positive outlook, investors must approach opportunities with caution and due diligence. Market fluctuations, global economic conditions, and project-specific challenges can influence returns. Feasibility studies, financial planning, and regulatory guidance are essential steps to mitigate risks. Partnering with advisory experts ensures that decisions are based on accurate market research and realistic projections.

Looking Ahead: Preparing for 2026 and Beyond

As the year comes to a close, investors should focus on aligning their strategies with long-term market shifts. The UAE will continue to attract global capital through its progressive policies, stable economy, and growing population. Those who take the time to understand current trends—residential demand, hospitality growth, sustainable development, and regulatory changes—will be best placed to capture the opportunities ahead.

Conclusion: Confidence Through Clarity

The UAE real estate market offers a wealth of opportunities, but success depends on informed decision-making. By staying aware of evolving trends and working with trusted partners, investors can reduce risks and unlock greater value from their portfolios.

Take the Next Step

Navigate the UAE property market with clarity and confidence. Contact Italian Development Group today to explore tailored advisory and development solutions that align with your investment goals.